Welcome to 2021!! The year 2020 was all about adapting. For real estate, the year started out as every other with increasing number of buyers trying to purchase homes while experiencing limited inventory of homes for sale. Then COVID-19 hit the United States in February/March with state governments shutting down various parts of the economy to hopefully reduce/limit the spread of the virus. Housing demand dropped; buyers started backing out of purchases as they lost jobs for the various reasons leading to many wondering what was going to happen. Would there be another housing crisis, recession/depression, etc???

By May/June, buyers came back into the housing markets due to historically and exceptionally low interest rates. Another contributing factor many did not foresee was people working from home. People could buy “their dream home” away from their employer knowing they did not need to commute daily or commute only occasionally as required for meetings, etc. An example would be people from the larger cities selling their home and buying a home on a lake “up north” or suburbs/country, working from there and commuting for meetings or as needed.

The housing market remained extremely busy throughout the balance of 2020. Many in the news media commented how housing was micro-economy keeping the overall economy afloat. Builders rushed to build more homes while contractors rushed to hire people to build homes. The housing market then experienced its next problems in August/September, low lumber supplies causing rapidly increasing lumber prices and appliances difficult to timely receive. Suppliers were not able to operate plants at full capacity to meet the higher-than-expected demand due to government COVID-19 regulations and employees’ home in quarantine or ill.

Even as prices for new homes started to increase, we saw no slow down in demand. Low interest rates gave and continue to give buyers the ability to buy homes.

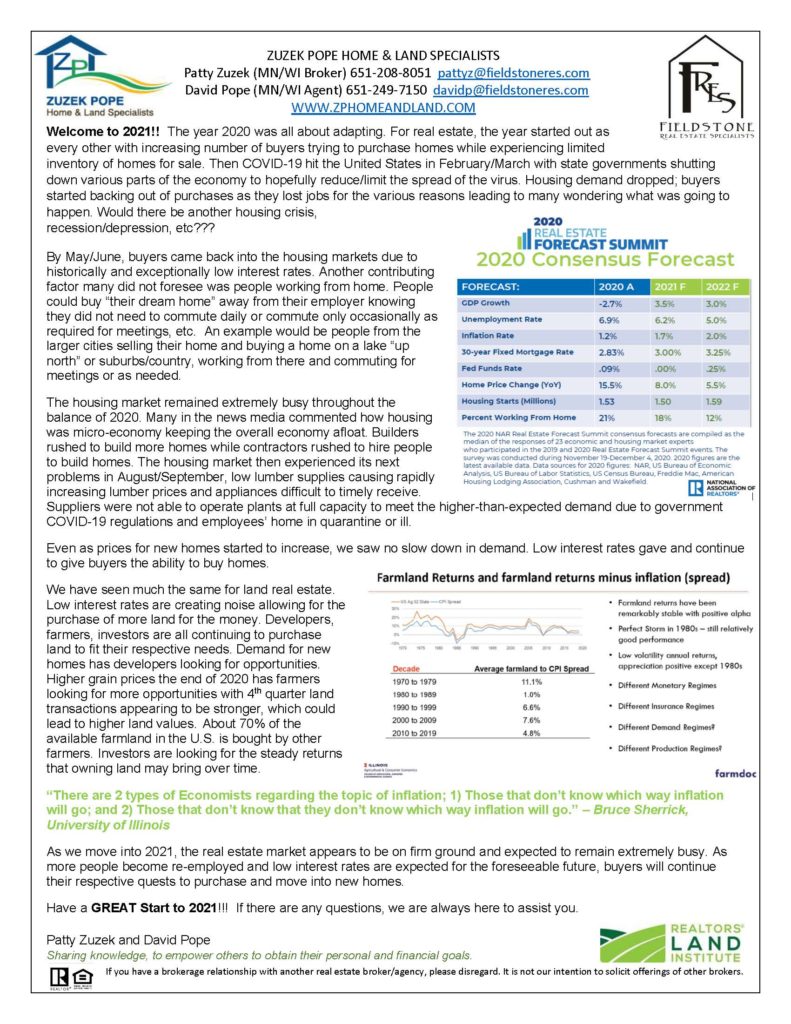

We have seen much the same for land real estate. Low interest rates are creating noise allowing for the purchase of more land for the money. Developers, farmers, investors are all continuing to purchase land to fit their respective needs. Demand for new homes has developers looking for opportunities. Higher grain prices the end of 2020 has farmers looking for more opportunities with 4th quarter land transactions appearing to be stronger, which could lead to higher land values. About 70% of the available farmland in the U.S. is bought by other farmers. Investors are looking for the steady returns that owning land may bring over time.

“There are 2 types of Economists regarding the topic of inflation; 1) Those that don’t know which way inflation will go; and 2) Those that don’t know that they don’t know which way inflation will go.” – Bruce Sherrick, University of Illinois

As we move into 2021, the real estate market appears to be on firm ground and expected to remain extremely busy. As more people become re-employed and low interest rates are expected for the foreseeable future, buyers will continue their respective quests to purchase and move into new homes. Have a GREAT Start to 2021!!! If there are any questions, we are always here to assist you.

»

»

Leave a Reply